Economic Impact Payments for SSDI and SSI Recipients [Infographic]

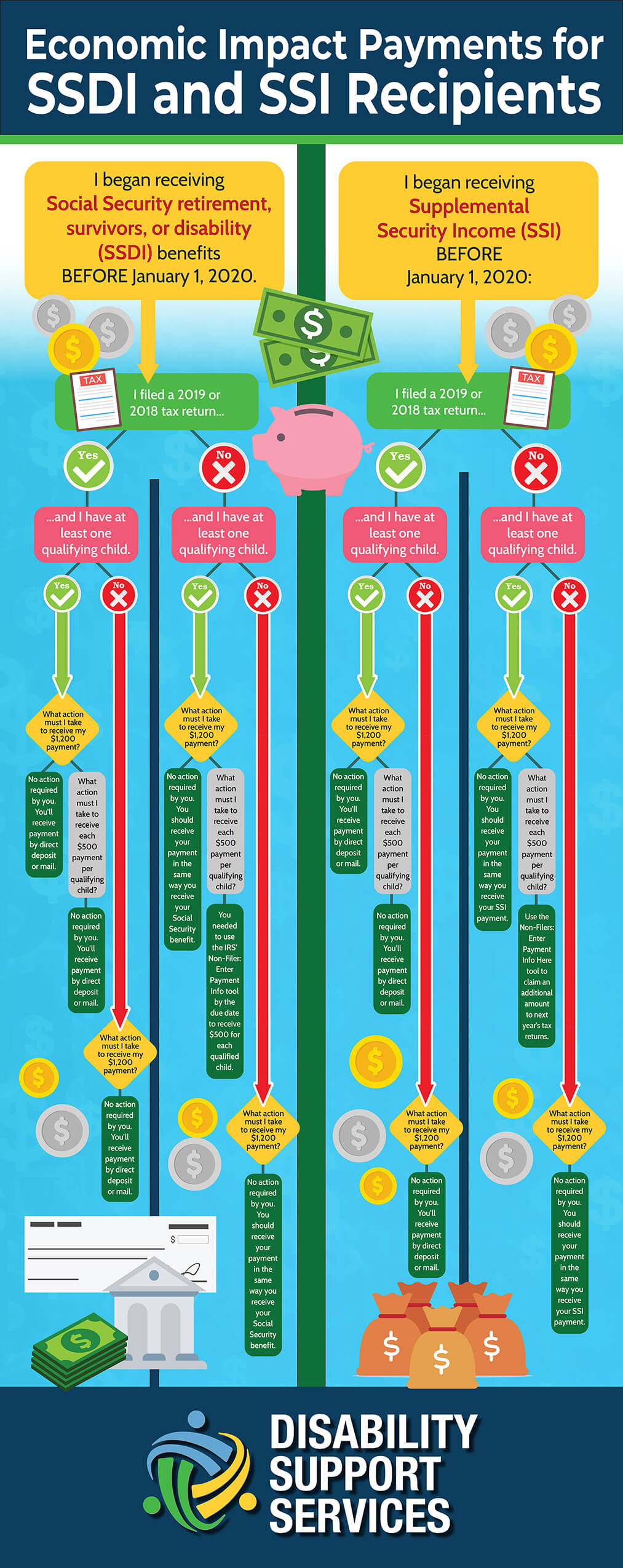

The SSA has a page dedicated to the update of COVID-19 economic impact payment and what that means for social security recipients. In it, they have an updated Economic Impact Payments (PDF) that outlines commonly asked questions. To help SSDI and SSI recipients with this PDF, DSS has created this easy to use infographic. It is a flow chart that outlines what to expect. Keep scrolling to see additional information.

Those Who Have Filed Taxes (2018 or 2019)

If you have filed taxes for 2018 or 2019, the IRS will be issuing electronic economic impact payments on or about April 15. This is only to people who received a tax refund electronically, and to the same account as the tax refund. If you did not get an electronic refund or no refund, the IRS will send your payment via mail. Payments will be issued on a staggered basis beginning in late April. You may be able to use the IRS’ Get My Payment tool to provide or update your bank information to receive an electronic payment more quickly.

Qualifying Child

You will also need to determine if you have a qualifying child. The IRS lists rules for the qualifying child applicable to the Child Tax Credit. The child qualifies if:

- The child is your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of them (e.g., your grandchild, niece, or nephew).

- Was under age 17 at the end of 2019.

- Did not provide over half of his or her own support for 2019.

- Lived with you for more than half of 2019

- Is claimed as a dependent on your return.

- They do not file a joint return for the year (or files it only to claim a refund of withheld income tax or estimated tax paid).

- Was a U.S. citizen, U.S. national, or U.S. resident alien.

The CARES Act also requires the qualifying child to have a valid Social Security Number or an Adoption Taxpayer Identification Number (ATIN).

If all these apply, $500 child payments will be issued as part of the same payment as your economic impact payments. You will only receive $500 for a qualified child listed on your tax return. For a child not listed on your tax return, you must wait to file the tax year 2020 tax return to receive the $500 payment.

Those Who Have Not Filed Taxes

You should receive your payment in the same way you receive your Social Security benefit or monthly SSI payment.

SSDI

Please see the checklist above to see if you have a qualifying child. If the IRS did not already process your $1,200 payment, and you entered your and your children’s information into the tool by the due date, you should receive each $500 child payment at the same time as your $1,200 individual payment.

Has the IRS already processed your payment, or you missed the deadline? You must wait to file the 2020 tax return to receive the additional $500 per qualifying child. Your $1,200 payment is not affected.

If you:

- are a direct express cardholder,

- used the Non-Filer tool by the deadline

- and you left the bank account information blank

You will receive your and your children’s combined payment amount by a paper check in the mail.

SSI

Has the IRS already processed your payment, and you made the deadline? You will receive each child payment with your payment in your next check. That is if you selected direct deposit in the tool. If not, mailed checks begin May 15.

If the IRS already processed your $1,200 payment, or if you missed the deadline, you must wait to file the tax year 2020 tax return to receive the additional $500 per qualifying child. Your $1,200 payment is not affected.

For direct express cardholders, if you used the Non-Filer Tool to enter dependent information, you will not receive your automatic $1,200 payment on your Direct Express card. You will receive both your payment and each child’s payment in a nonDirect Express bank account you may have provided. If you left the bank information empty, it will be sent by mail. This is only if the IRS did not already process your $1,200 payment. If you did not use the NonFiler Tool, you will receive your automatic $1,200 payment on your Direct Express card, and you will need to file a tax return next year to get a $500 payment per qualifying child.